While consumers turned to online grocery shopping at unprecedented levels this year, the platform still presents challenges for the candy industry.

During the pandemic, 61 percent of consumers have purchased groceries online and 26 percent have purchased confectionery online. However, 46 percent of shoppers agree that they are more likely to purchase candy when in store.

That’s according to a new report from The National Confectioners Association, “Confectionery Sales Amid COVID-19: 2020,” which focuses on the impact of the COVID-19 pandemic and the new buying behaviors that have emerged as a result.

The report is the second in the NCA’s three-part insights-driven series that explores the impact of COVID-19 on consumer behavior and seasonal and everyday confectionery sales.

The NCA said the data shows that pandemic-driven changes in shopping, working and social routines prompted extraordinary change for the confectionery category. Shoppers bought different package sizes, brands, items and in different stores.

All the while, the virus controls the timeline and demand forecasting for holiday and everyday demand has become even more complex as retailers and manufacturers alike are navigating uncharted territories. The NCA said the study aims to bring an understanding of consumer attitudes and behaviors relative to the consumption and purchasing of confectionery amid the pandemic.

Below is a look at some of the insights shared in the executive summary of the report. The full report is available to NCA member companies, Sweets & Snacks On Demand participants and select retail partners at CandyUSA.com/COVIDReports. An executive summary of the report is also available to the entire confectionery industry.

Data revelations:

The period between March 15 and Sept, 6 is referred to as the 26-week pandemic period throughout the study.

Confectionery sales mixed during pandemic period

- Chocolate sales gained 5.5 percent.

- Non-chocolate sales are strengthening as convenience store traffic is rebounding, for an overall pandemic gain of 1.6 percent.

- Gum and mint sales have been challenged as the pandemic uprooted many work, school and social routines.

Grocery channel remains strong, C-Stores rise since summer

The grocery channel has been the main beneficiary of the pandemic channel shifting and its confectionery gains are far above average.

Convenience store confectionery sales have been rising since July and August.

Most people have eaten chocolate, non-chocolate candy

The vast majority of people have consumed chocolate (92 percent) and nonchocolate (80 percent) during the pandemic.

Some consumers reduced how much candy they ate

Around 10 percent of people reduced their candy consumption. They point to taking fewer grocery trips and trying to eat a little less of it with an eye on balance as the chief reasons for doing so.

Gum and mint consumption declines

Fewer people have consumed gum or mints during the pandemic (64 percent, each), with social distancing lowering engagement.

The top reason for consuming less is being around people less, including working from home, followed by eating out less.

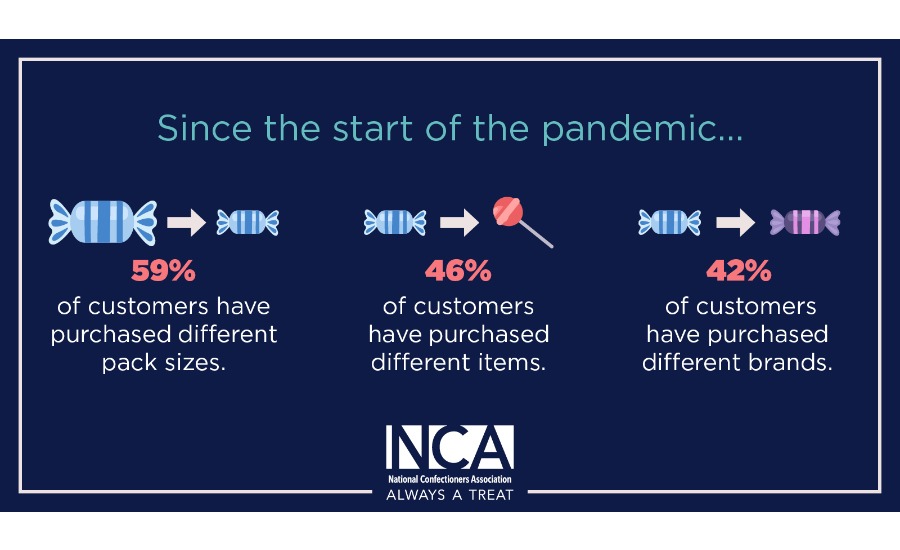

Most consumers changed candy purchases patterns

Nearly six in 10 shoppers changed up their candy purchases amid the pandemic, including buying different pack sizes (48 percent), different types (46 percent) and different brands (42 percent).

This was driven by out-of-stocks, looking for better value, and changed routines, such as working from home, buying for different members of the household and more experimentation.

Movie theaters, book stores, candy stores suffer

Consumers bought confectionery in many fewer outlets. While grocery grew, alternative channels in particular, such as movie theaters, book stores or candy stores, were hit by the pandemic purchasing shifts.

E-commerce grocery sees huge gains, but candy suffers

E-commerce leaped forward with 61 percent of consumers having purchased groceries online during the pandemic and 26 percent having purchased confectionery online.

Closing the gap would be an important win for the confectionery industry, but 46 percent of shoppers agree that they are more likely to purchase candy when in store.

Growth trajectory fundamentally changed

The pandemic fundamentally changed the growth trajectory of many departments in food retail, including confectionery. Most saw unprecedented spikes in sales mid March as shoppers prepared for shelter-in-place mandates.

Retail sales continue to track well above 2019 levels six months into the pandemic.