Dark Chocolate

Now that the ‘chocolate bar’ has been raised towards more premium varieties, retailers need to strategize to capture an even higher-impulse chocolate market.

Overview

C’mon, tell us your deepest, darkest, candy

desires — and chances are, they’ll be covered in dark

chocolate.

Because of “evolving” consumer tastes,

there’s not a chocolate maker around that hasn’t seriously

thought about — and more than likely, now gone the route of —

the dark side, at least to some degree. It seems the more bitter, the

better these days, thanks to refined palates and a flood of health news

surrounding chocolate with higher cacao/cocoa content and less sugar

content.

Making up about 11 percent of the total chocolate

market, dark chocolate is $510 million dollars strong, with sales growing

43 percent vs. a year ago, according to the latest 52-week information

supplied by ACNielsen.

A growing sub-set of the dark chocolate segment is the

emergence of origin and organic concepts.

Overlapping (or perhaps more accurately, enrobing)

dark chocolate with other popular consumables, such as savory snacks and

mints, is another hot spin-off, often creating products that are perceived

to be even more “gourmet” and commanding higher price points

than the “naked” versions of the products.

Target Audience

It used to be that more ethnic, affluent, and/or

European-traveling consumers were the best target for dark chocolate sales

in this country. Today, the mass appeal of gourmet coffee houses (often now

selling dark chocolates, by the way), as well as the rise in chocolate

cafes and the healthy hype surrounding dark chocolate, has contributed to

the desire for more “good quality daily chocolate breaks” from

adult consumers of all walks. And that means more dark chocolate for

everybody; the sensory experience of enjoying dark chocolate has become

powerfully and universally appealing.

That said, this is not a category to target to kids or

teens that typically do not have the palates for “candy” with

less sugar, more bitter flavors.

The ideal audience is still adults with refined

palates — and those used to savoring these not-so-guilty-anymore

pleasures. Chances are, too, that if you have wine connoisseurs or strong

coffee drinkers as your customers, you have built-in dark chocolate lovers

to target.

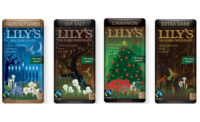

And let’s not forget about the female market

segment; dark chocolate manufacturers certainly have not. New packaging

reflects a feminine appeal, not only in colors, fonts, but in clever

sayings as well — such as those that play up the “PMS

relief” aspect of their “dark” food.

Pricing/Positioning

With dark chocolate perceived as more

“gourmet” chocolate (and often, the two categories overlap

greatly), it commands higher price points, even from those consumers who

are buying it through mainstream retail channels. Currently, dark chocolate

bar prices often start at $1 an ounce, but can easily exceed $1.50 or even

$2 an ounce.

Seasonal Opportunities

Sure, there are opportunities to sell more dark

chocolate on holidays, but that’s just because more people are

enjoying it all year long. Perhaps the best seasonal news about dark

chocolate is that it can be both a “Valentine’s Day

extravagance” and an “everyday indulgence.” This means

that consumers will pick up a box of dark chocolates for a loved one on

Valentine’s Day, Easter, Mother’s Day, etc., and be

simultaneously reminded to buy a bar or bag, or both, of dark chocolate for

their own consumption during the week. Dark chocolate, it is predicted,

begets dark chocolate. Therefore, cross-merchandising

“everyday” dark chocolate with “seasonal”

selections is a natural opportunity.

Outlook

Moving forward, expect to “see the dark”

from all chocolate manufacturers, no matter how mainstream. Those already

in it will aim for even “higher” dark places. Cocoa

connoisseurs are emphatic that the industry will continue to see the rise

of single-estate and varietal chocolate; the most discerning consumers will

search for cacaos of different continents, countries, regions within

countries and even farms within a region.

The word is that the industry can expect to see more

chocolate actually made where the cacao is grown; right now these

bean-to-bar chocolate makers are primarily in Europe and the United States,

but Venezuela and Ecuador are catching on quickly.

Another trend — “hot” chocolate will

become literal. While the Mexicans have laced their chocolate with spices

for centuries, American consumers’ taste for more sophisticated

chocolate has led to the up-and-coming coupling of darker chocolate

(starting in specialty, but migrating to the masses) with spicier, more

savory, ethnic flavorings, such as: all kinds of pepper, including black

and cayenne; ancho chiles; lemon and lime; intense cinnamon; ginger;

paprika; pine nuts; cloves; sea salt; rosemary, and even sun-dried

tomatoes.

An additional dark treat on the horizon —

“rustic” chocolate bars, which will allow consumers to crunch

into cocoa nibs and sugar crystals.

$510

million

Dark Chocolate Estimated U.S. Retail Market Size

Source: ACNielsen

Dark Chocolate Estimated U.S. Retail Market Size

Source: ACNielsen

Merchandising Musts

• Shine the light on a dark place. Dark chocolate definitely deserves its own special place in

the candy planogram these days. The latest category success has reportedly

been generated by merchandising all of the dark products in a dedicated

dark chocolate section — and perhaps providing accompanying

explanation graphics, such as those that some bar suppliers now offer.

• Make healthy hints. Knowing

that consumers recognize the health benefits of dark chocolate,

cross-merchandising it with other products rich in anti-oxidants, such as

wine, or even colorful fruits like berries, is a wise idea. Keep in mind,

though, that most chocolate manufacturers will not make any health claims

for their dark products, and neither should retailers. In this instance, it

is best to let consumers make their own health conclusions/purchase with

their own health perceptions. But it certainly doesn’t hurt to

merchandise logical (and attractive) pairings.

• Let them trade up. The

dark chocolate cocoa content has turned into a numbers game, and retailers

should be prepared to let consumers “trade up” as their taste

buds become more refined/less inclined to want a sugary taste. Planograms

should include bars with lower, more “beginner” cocoa content

(such as 60, meaning that about 40 percent of the bar is made up of sugar),

then middle-ground bars with about 70-72 percent cocoa, and finally, have

those that are for the “most serious” dark chocolate lovers,

some at 85 percent or 92 percent. In fact, at least one manufacturer now

offers a 99 percent “killer” cocoa bar in its portfolio.